Happy Friday, everyone! We survived the first week back from the holidays. That’s an accomplishment. 🙂

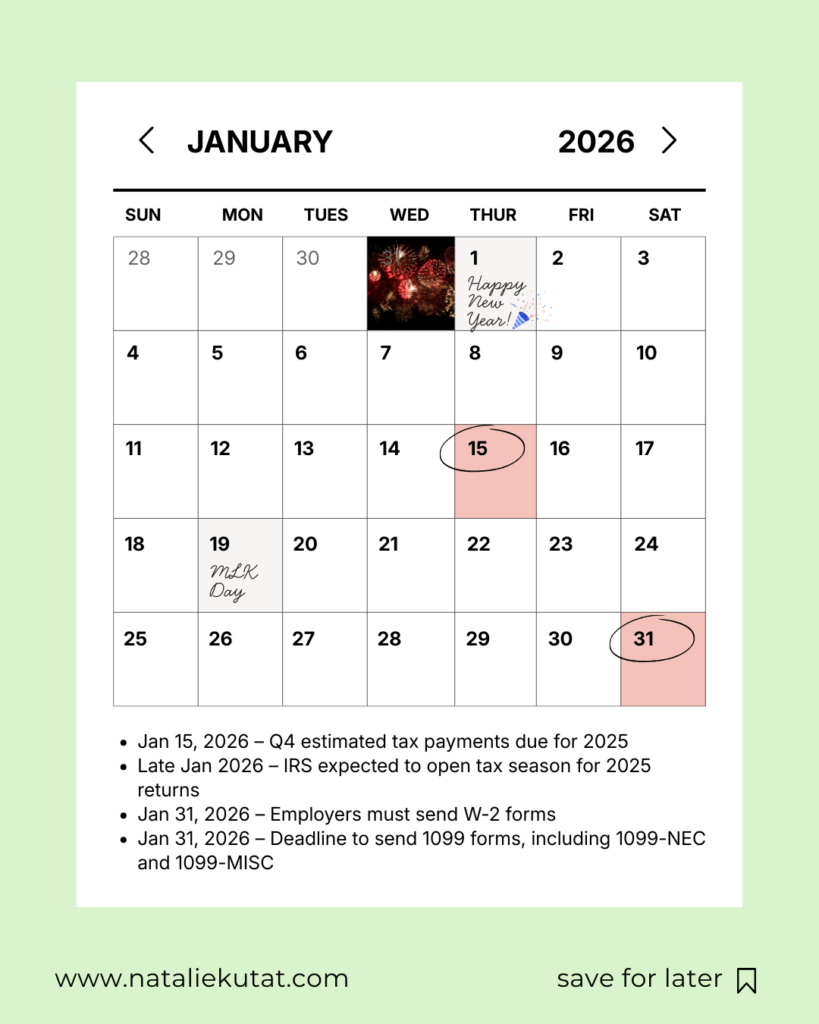

Now that we’re jumping right into things, I wanted to let everyone—whether you’re an individual or you have a business—about upcoming tax deadlines this January. There are a few of them!

- January 15, 2026: Q4 2025 estimated tax payments are due. This applies to individuals and businesses. (Note: not all individuals will have to make these. If you don’t know whether you need to or not, contact me, your friendly local CPA!)

- Late January 2026: The IRS is expected to open tax season for 2025 returns. Get ready!

- January 31, 2026: Employers have to send W-2 forms. If you’ve worked for a company at all in 2025, even if it wasn’t very long, you’ll be getting one of these. Note that a lot of companies have online delivery these days, and they don’t always notify you, so keep an eye on the relevant online systems. If you have a question, contact your company’s HR or Payroll department. I’ve had to do that before, and it’s very helpful. They don’t bite! 🙂

- January 31, 2026: Deadline to send 1099 forms, including 1099-NEC and 1099-MISC. Whether you’re receiving these or need to send them, be prepared! If you receive one (or more), compare it to your records to make sure the amount is correct. If you’re sending them, make sure you have your W-9’s on file for your payees! It’s good practice to get this when you onboard someone. In real life, I know this doesn’t always happen. But maybe it would be a good New Year’s Resolution for this year? 🙂

Enough with my ramblings. Here’s a handy graphic to remind you of what’s due when. And remember, as tax season kicks off, it’s not too late to hire an accountant to help you with bookkeeping, tax, or both. I am actively building a client list and I’d love to work with you!

I’m Natalie, a CPA. I run an accounting firm focused on bookkeeping, tax, and virtual CFO services, and I work with individuals and small businesses. I’d love to work with you, so if you want to see how I can help you keep your records clean and tax-compliant, please email me or schedule some time here.

Leave a Reply